Dirty campaigning has come to dominate Malaysian politics where, to the less discerning, even lies spun by the opposition had become percepts of the truth.

The usually all endearing and trusting Malaysian voters are now fixated by this new brand of political campaigning. The dirtier the spins the more excited and stimulated they become.

The oppositions are taking full advantage of negative campaigning to demonise the government.

The opposition Pakatan Rakyat predicted doomsday for the country if the current government is voted into power again.

Was there any assurance that Pakatan Rakyat can do better or they will be caught in their own lumber?

They used the increasing debt to GDP ratio as the catalyst that would catapult the country into bankruptcy and economic disaster for the people. Another attempt to hoodwink the public.

With the prevailing economic fundamentals that would be far fetched scenario.

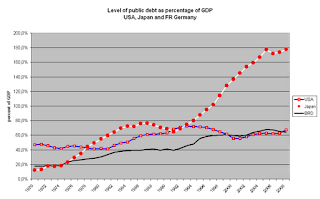

Malaysia is not yet destined for the death bed, public debt which may seem high to the layman is not in dangerous territory yet, Malaysia's debt to GDP ratio is within manageable level and far lower than most developed Western nations in Europe and the Americas, many of which have much higher debt ratio.

Below are debt to GDP ratio of Malaysia and various other countries.

U.K.National debt

As you can see, we are still in positive territory compared to larger economies such as the U.K.and the U.S. who have borrowed to the hilt.

The U.S. hit the debt ceiling in 2011 whereby they have to go to Congress to increase the debt ceiling or face the grim prospect of defaulting on its debts. Faced with the imminent danger of becoming the biggest pariah and laughing stock of the world, Congress had no choice but to allow the increment. The U.S. insatiable appetite for more and more money to feed its overburdened budget may one day ruin not only the country but the whole world. It is the biggest world debtor.

The question is why are Western nations allowed to borrow seemingly beyond its capability to service its debts? The answer is simple, it's perceived credibility and confidence.These countries are seen as responsible nations that are not likely to default on its debt repayment.The world financial community have been more than willing to lend to these countries until the Greeks defied the law of gravity and demolished the invincibility of Western economies.

Why is Greece in trouble?

Greece trouble was not because of its borrowings but because of overspending. It was living beyond its means. It just can't produce enough goods and services to repay its debts.Public sector wages, for example, rose 50% between 1999 and 2007, faster than other eurozone countries.There were also widespread tax evasion hitting its revenue badly.After years of overspending, its budget deficit spiralled out of control.

Is Malaysia likely to default on its debts? Not in the short and medium term but much depend on how the government is going to reduce its budget deficit over the years. Malaysia must take a leaf out of the Greek's book if she is to learn how to avoid such acutely damaging financial mismanagement.

Malaysia is not likely to default on its debt in the near future.

The next possible country debt default is likely to be in Europe again. Spain, Italy and for that matter Portugal and Ireland are all in shaky financial situation and faced a contracting economy. If no remedial actions are taken by the countries concerned they may need a lifeline and a lifeboat to keep them afloat or face the grim prospect of sinking with the debts.

Many African countries have very low debt to GDP ratio, which, if one were to go by Pakatan Rakyat's fallacious argument and low debt philosophy, which they proudly claimed they have achieved through cost-cutting expenditure in Selangor and Penang, is a hyperbole. They boasted of good surpluses in their reserves.

A country that don't spend enough for the people cannot bring prosperity to the nation. It can also lead to stagnation of the economy just like some of the African states, it's gone so bad no one would want to lend them money.

Would you for a moment think life in Angola and Ghana is better than in Malaysia?

Angola, is the biggest crude oil producer in Africa producing almost 2 million barrels a day of crude oil yet it is still poor and one of the most politically unstable country in Africa, embroiled in civil war for 27 years, because every political leader want to lay his hand on the oil money. Sadly, 40% of its population is still living below the poverty line and rebellion continue to haunt every government that comes into power.

In the event they win the federal elections let's hope Pakatan leaders are not coveting the wealth of the nation and hope they will govern the country as they have promised.

In the case of those African countries, do you know why they have such low debt to GDP ratio? They have no credibility, nobody dare or want to lend them money, if someone dare take the risk they would charge very high interest rate compared to countries with less sovereign risk and better credit rating.

You can read debt to GDP ratio of 133 countries here and would see through the opposition lies and dirty campaigning. Here, Lim Guan Eng predicted that Malaysia would be bankrupt by 2019 and Malaysians should vote for DAP and Pakatan, which some economists predicted would bankrupt the country within two years of taking power if they implement all their promises.

Sometimes, they can't tell between fact and fiction, the good, the bad, the ugly and worst of all trying to fool the majority of Malaysians with their crappy tales.

The choice is yours between the devil you know and the one in the deep blue sea.

1 comment:

Pergh great article!

Post a Comment